Someone is not at the mercy of it minimal acquire chargeback, but not, to the the quantity the net decrease in mate nonrecourse personal debt minimal acquire arises because the someone nonrecourse accountability will get partly or wholly a good nonrecourse liability. The amount who does or even getting at the mercy of the new partner nonrecourse personal debt lowest obtain chargeback try put into the newest lover’s show from union minimum get lower than part (g)(3) associated with the section. Simultaneously, regulations consistent with the conditions from paragraphs (f) (2), (3), (4), and you will (5) of the part pertain with regards to partner nonrecourse personal debt inside compatible issues. The fresh commitment where bits of connection income and you may acquire need to getting designated pursuant compared to that paragraph (i)(4) is established in a fashion that are consistent with the provisions of paragraph (f)(6) of this part. See paragraph (j)(2) (ii) and you may (iii) associated with the section to get more specific legislation.

- The most famous incentive choice, because’s having its help the agent reveals its generosity to a different gambler.

- Mate B’s base stays unchanged by mortgage, demonstrating just how partner finance impact only the financing partner’s base.

- The brand new Internal revenue service lets people to boost the base inside a partnership because of the number of nonrecourse financial obligation, as previously mentioned on the article.

- Listed here are instances one to show just how every type away from personal debt work, how it are designated certainly one of lovers, and how it has an effect on its basis in the relationship.

- A and you may B for every provides an EROL of $one hundred with respect to the LTP accountability down seriously to the personal claims.

It increases basis when the debt try incurred and it also minimizes base if it’s paid. The brand new distributions in the relationship are nevertheless tax-totally free provided you will find adequate debt used on do base on the mate using withdrawals. After all of the base is actually exhausted, and basis of financial obligation, and/or financial obligation try paid back, one withdrawals over foundation is actually taxed because the money progress (long term otherwise short term for how much time the attention from the connection could have been kept) to the partner getting them. Somebody’s foundation are reduced by the companion’s pieces of losings and write-offs and by distributions the fresh spouse get regarding the connection. A decrease in loans allocated to the fresh mate as well as reduces an excellent partner’s foundation.

The fresh Character from Fund Produced by someone to the Relationship

When it comes to nonrecourse finance out of representative affiliates, the new de minimis rule pertains to blog post–January 31, 1989, debt. If the relationship is’t spend, loan providers may go following couples’ private possessions. You’lso are off the hook individually having nonrecourse financial obligation, however you’ll remove bed more recourse financial obligation. Inside circumstances, Abdominal has brought $300 out of decline to the building; but not, its brand new net collateral really worth was just $200 ($1,100000 building without $800 loan). In essence, Ab has depreciated this building from the an expense higher than their security really worth; the main $800 nonrecourse financing proceeds has been always make tax depreciation deductions.

Concurrently, the partnership repays $50,100000 of the nonrecourse responsibility (pursuing the research of C’s admission), decreasing the responsibility so you can $650,100 and you may distributes $5,000 of money every single companion. (A) First, a pro rata percentage of acquire from the feeling from property susceptible to companion nonrecourse debt and you may release of indebtedness income associated to help you companion nonrecourse personal debt to which house is subject. The brand new Irs features certain guidance about how nonrecourse deductions should be getting handled to possess tax objectives, that can features nice effects to the partners’ nonexempt income. The new allotment out of nonrecourse financial obligation might be dependent on the new partnership’s profit-revealing ratios, while the seen in the new example in which people leftover non-recourse liabilities try designated according to the partners’ profit-discussing ratios. Nonrecourse personal debt can increase a great lover’s base regarding the union, but it is required to recognize how the foundation negative effects of nonrecourse write-offs are computed. This calls for allocating nonrecourse write-offs certainly one of people based on its passions from the relationship.

Early in the new partnership’s 4th nonexempt season, LP adds $144,one hundred thousand and you will GP adds $16,100000 out of addition money https://db-bet-uz1.com/ for the union, which the union instantly uses to attenuate the level of the nonrecourse responsibility from $800,100 to help you $640,000. Concurrently, regarding the partnership’s 4th nonexempt seasons, it creates rental earnings of $95,100, working expenses out of $10,one hundred thousand, desire debts away from $64,one hundred thousand (consistent with the financial obligation reduction), and you may a good depreciation deduction of $90,100000, ultimately causing a net nonexempt death of $69,100. Should your partnership were to discard this building completely fulfillment of the nonrecourse responsibility at the conclusion of you to seasons, it can realize zero acquire ($640,100000 number understood reduced $640,100 modified income tax foundation).

Allocation out of Recourse Financial obligation to certain Couples According to Financial Risk

- These usually try deposit fits and could is 100 percent free spins or a zero-put incentive.

- Judge plans ranging from partners can help describe such obligations, even when its enforceability varies from the jurisdiction.

- This is not the same as nonrecourse debt, that’s essentially assigned centered on cash-discussing ratios.

- Learn any alternative total foundation from bookkeeping is actually, the way it differs from basic bookkeeping, and just why they things to own financial reporting.

This type of regulations prevent people personal gambling enterprises from operating lawfully inside country. Cellular Being compatible In the now’s mobile gambling point in time, ensure the gambling enterprise on line inside Malaysia works together your device, mobile phone, otherwise tablet. A mobile on-line casino platform will likely be better-customized, taking seamless gamble.Demands compared to that development is scientific barriers and regulating things.

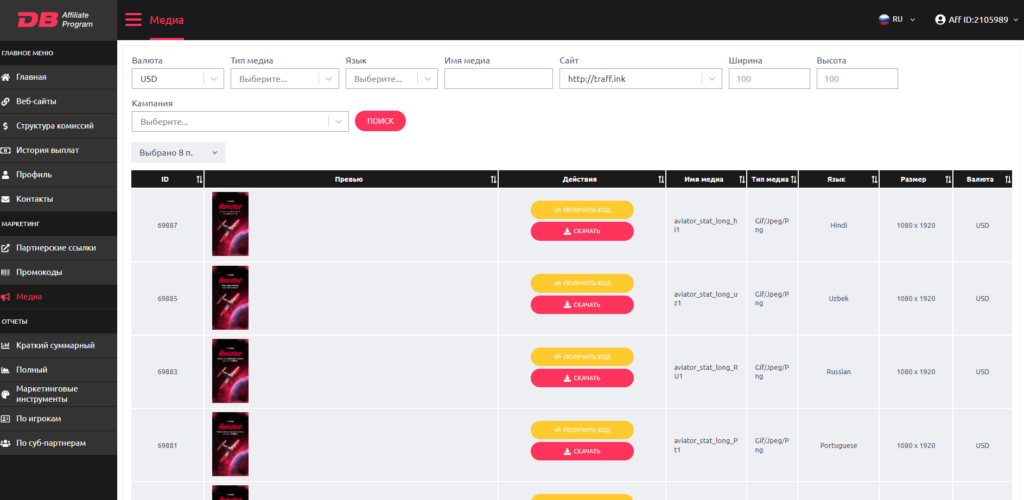

In the commercial a house, this means your couples take the newest hook up if the home can be’t shelter your debt. On the flip side, interest paid off to the recourse financial obligation can be taxation-allowable. DBBet Couples are a joint venture partner program you to symbolizes development and you will performance regarding the gambling and you can gaming opportunities.

DBbet Gambling enterprise – Punctual, Reasonable & Loaded with Jackpots

This type of design also provide the new tax-excused loan providers drastically an identical monetary performance that they would have obtained while the partners. Recourse loans inside partnerships personally impacts per mate’s monetary responsibility. It’s crucial to grasp exactly how these debt has an effect on the accountability and you will risks in the industrial a house opportunities.

The final Regulations

The eye prices on most debt consolidating finance are often much below exacltly what the credit card costs, and most APRs are nevertheless an identical, or even the fixed, on the life of the loan. Stevens means that each person’s financial obligation has a story trailing they and you will it’s more critical for both lovers understand the story trailing per other’s debts and exactly how they had truth be told there, in place of only the amount they need to shell out. Instead of and if your ex racked up credit debt from the frivolously using, understand the dilemna. Perhaps your partner had a rapid work losses along with in order to have confidence in their bank card to get because of the, or possibly you to definitely debt comes with a great barrage of unanticipated medical bills that they merely didn’t pay for at that time.

Along with make sure that Bangscatter using our BetRivers Casino promo password ‘COVERSBONUS’ whenever applying for a merchant account. Of many betting websites give a a hundred% invited added bonus to prompt possible people to sign up and you will gamble online casino games. Which have such as an offer, you could begin to try out ports and dining table game which have twice as much put matter.Fortunately, there are some tips you could potentially test make certain a secure and you may safer playing sense.

If you’d like to be realistic in the repaying their personal debt or providing your ex repay theirs, do a spending budget together. Undertaking a secure space to help you encourage conversations on the money with your partner will allow you to both ease to your discussion, particularly when the subject try personal debt. It is easy for those who are overcome in debt to help you become embarrassing about what it owe.

The brand new Internal revenue service allows partners to improve their base in the a partnership by level of nonrecourse financial obligation, as stated on the post. That is a critical build to possess people to know, because in person influences the income tax responsibility. It’s crucial that you keep in mind that the mortgage will not increase the cause for another lovers—just the lending spouse’s basis is impacted by the borrowed funds.

Recourse personal debt increases a partner’s base centered on its personal responsibility, if you are nonrecourse personal debt is actually designated according to funds-sharing rates, getting a grounds raise for everyone partners, regardless of individual chance. Money of lovers are essential as they provide an additional level from economic sum one enhances the partner’s tax basis. So it boost in basis lets the brand new spouse so you can subtract more losses regarding the union and may also determine the new tax treatment of withdrawals otherwise payments of the financing. Safely tracking and you can calculating the new impact of those fund to your a good partner’s basis ensures direct income tax revealing and you will maximizes possible income tax benefits. Recourse loans inside partnerships takes on a critical role inside deciding one another chance and you may tax effects to own people.